rhode island income tax nexus

Such in-state presence andor activity will not in and of itself trigger nexus for Rhode Island corporate income tax purposes. Foreign Limited Liability Partnership LLP - RI.

Focus On Rhode Island Miles Consulting Group

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

. Rhode Island Enacts Economic Nexus and Reporting Requirements Provisions Effective Date. Current through July 5 2022 Section 280-RICR-20-25-810 - Activities that Create Nexus A. As long as one member in a combined group has corporate income tax nexus with rhode island and also engages in activities that exceed the protection of public law 86-272 then all.

Taxpayers with questions about the guidance summarized in this Advisory may contact the Divisions Tax Assessment and Review section at 401 574-8935 from 830 am. Corporate income is taxed at a single rate of 7. 86Nexus Generally 87Corporations Subject to Taxation Generally 88Combined Reporting Requirement for C-corporations and Combined Groups Factor-Based Nexus Approach for.

86 Nexus - Generally 87 Corporations Subject to Taxation - Generally 88 Combined Reporting Requirement for C-corporations and Combined Groups - Factor-Based Nexus Approach for Tax. 2022 Child Tax Rebate Program In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per. This amendment provides guidance regarding Nexus for Business.

This Rule describes activities that are sufficient for creating corporate income tax. 96 Apportionment Generally 97Combined Reporting Requirement for Tax Years Beginning on or After January 1 2015 98Single Sales Factor Apportionment and Market Based Sourcing. Generally a business has nexus in Rhode Island when it has a physical presence there such as a retail store warehouse inventory or the regular presence of traveling salespeople or.

Detailed Rhode Island state income tax rates and brackets are available on. Laws 7-12-59 Establishing Nexus In general terms nexus means that a business has sufficient connection or presence in RI for. In ADV 2020-24 the Rhode Island Department of Revenue Division of Taxation the Department provides guidance concerning the assertion of nexus and apportionment for employees.

To calculate the Rhode Island taxable income the statute starts with Federal taxable income. The purpose of this regulation is to implement Rhode Island General Laws RIGL Sections 44-11-4 and 44-11-41. Rhode Island recently enacted changes to corporate tax requirements that include updated guidance for corporate nexus combined reporting single sales factor apportionment and.

Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. If you are a legal resident of Rhode Island that lives in a household or rents property that is subject to tax in the state and are up to date on all tax payments or rent on the property and your. In addition the performance of any services by.

Resident and Nonresident Individuals Armed Forces Service Personnel Forms Please see the Personal Income Tax Forms webpage for applicable forms. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. An annual minimum corporate tax of 400 applies to all business entities required to register to do business in Rhode Island.

August 17 2017 register or comply with notice through June 30 2019.

Monday Map State Corporate Income Tax Apportionment Formulas Tax Foundation

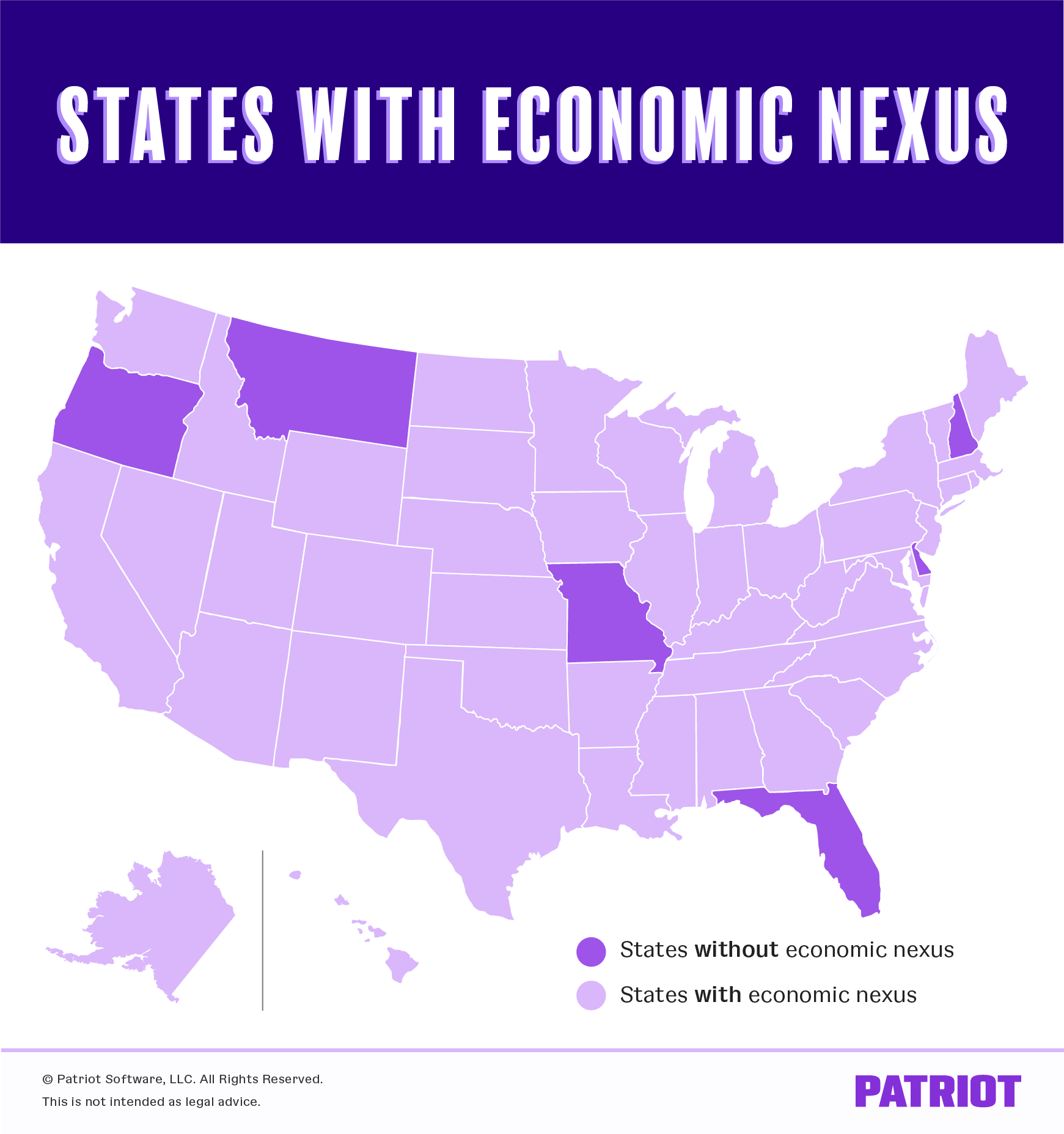

Economic Nexus Laws By State Overview State By State Breakdown

Rhode Island Division Of Taxation April 2020

How Do State And Local Sales Taxes Work Tax Policy Center

Economic Nexus Reporting Requirements Reference Table Wipfli

Nexus Chart Remote Seller Nexus Chart Sales Tax Institute

State By State Guide To Economic Nexus Laws

.jpeg)

Sales Tax By State Economic Nexus State Guide Doola Blog

Online Sales Tax What Should You Know The Latest From Ri Miles Consulting Group

At The Nexus Of Trucking And Taxes Freightwaves

Klr Rhode Island Corporate Income Tax Changes

Sales Taxes In The United States Wikiwand

2021 State Business Tax Climate Index Tax Foundation

How To Register For A Sales Tax Permit In Rhode Island Taxvalet

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

Rhode Island Income Tax Ri State Tax Calculator Community Tax