tn vehicle sales tax calculator knox county

TENNESSEE SALES TAX AND OTHER FEES. There is a 3600 wheel tax in Knox County for all motorized vehicles and cycles.

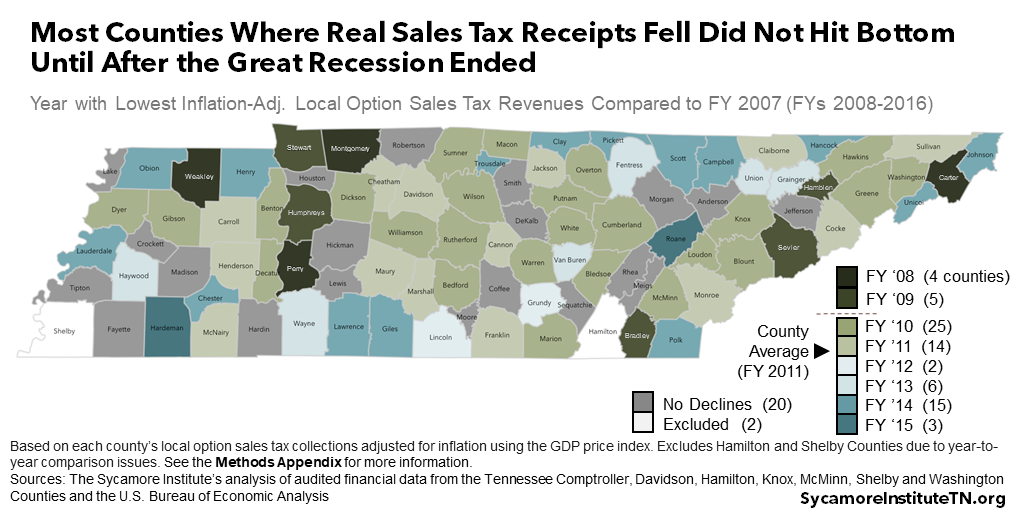

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

. In addition to taxes car purchases in Tennessee may be subject to other fees like registration title and plate fees. The few exceptions to this rule are when vehicles or boats are sold. This tax does not apply to trailers.

423-279-2725 Other Locations Vehicle Sales Tax Calculator. The 2018 United States Supreme Court decision in South Dakota v. Heres the formula from the Tennessee Car Tax Calculator.

77 is the fee for a standard plate. Motor vehicle or boat is subject to the sales or use tax. Vehicle Sales Tax Calculator.

Union City TN 38281 Phone. One of a suite of free online calculators provided by the team at iCalculator. See below for an itemization of this charge.

The median property tax on a 15230000 house is 109656 in Knox County. Title fees should be excluded from the sales or use tax base when. WarranteeService Contract Purchase Price.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. The total sales tax rate in any given location can be broken down into state county city and special district rates. 15 to 275 Local Tax on the first 1600 of the purchase.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales tax in Putnam County Tennessee is currently 975. Owners meeting the exemption criteria as set forth in the Knox.

TN Auto Sales Tax Calculator. Knox County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Knox County totaling 225. If this rate has been updated locally please contact us and we will update the sales tax rate for Putnam County Tennessee.

The current total local sales tax rate in Knox County TN is 9250. Specialty plates for some organizations require proof of membership. Knox County collects a 225 local sales tax the maximum local sales tax allowed.

The sales tax rate for Putnam County was updated for the 2020 tax year this is the current sales tax rate we are using in the Putnam County Tennessee Sales Tax Comparison Calculator for 202223. For 2022 renewals please review the 2022 Affidavit for Wheel Tax Exemption to see if you qualify. The December 2020 total local sales tax rate was also 9250.

Between spouses siblings lineal relatives parents and children grandparents and grandchildren great grandparents and great grandchildren or spouses of lineal relatives. For vehicles that are being rented or leased see see taxation of leases and rentals. The one with the highest sales tax rate is 37754 and the one with the lowest sales tax rate is 37721.

There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. From a sole. Vehicle Sales Tax Calculator.

The median property tax on a 15230000 house is 103564 in Tennessee. To review the rules in Tennessee visit our state-by-state guide. The Knox County sales tax rate is.

US Sales Tax Rates TN Rates Sales Tax Calculator Sales Tax Table. Tennessee sales and use tax rule 1320-05-01-03 Charges made by a dealer to customers for title fees are considered pass through charges excludable from the sales price of the motor vehicle or boat. Has impacted many state nexus laws and sales tax collection requirements.

WarranteeService Contract Purchase Price. The most populous zip code in Knox County Tennessee is 37918. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes.

Automating sales tax compliance can help your business keep compliant with changing sales. Sales tax will be collected on the purchase price of the. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. Typically automobile and boat sales in Tennessee are subject to sales or use tax.

Fees vary and are more expensive for specialty and commercial tags. There are exemptions from the Wheel Tax under certain conditions. This leaves 80 due at the time of registration to be paid by the registrant.

In most cases the total cost for titling and registering your vehicle in Knox County is 7700. Box 950 Lebanon TN 37088 Phone. WarranteeService Contract Purchase Price.

3258 Highway 126 Blountville TN 37617. Smithville TN 37166 Phone. A single article tax is another state tax to consider when purchasing a car.

Dekalb County James L Jimmy Poss. 7 State Tax on the sale price minus the trade-in. As far as other cities towns and locations go the place with the highest sales tax rate is Heiskell and the place with the lowest sales tax rate is Corryton.

This table shows the total sales tax rates for all cities and towns in Knox. Tennessee collects a 7 state sales tax rate. The maximum charge for county or city sales tax in Tennessee is 36 on the first 1600 of a cars purchase price.

The median property tax on a 15230000 house is 159915 in the United States. Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 Clerk negotiates check for 1771 TN sales tax paid by dealer if County Clerk has received the payment from dealer. 275 Single Article Tax from the second 1600 up to 3200.

Tennessee County Clerk Registration Renewals

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee County Clerk Registration Renewals

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee County Clerk Registration Renewals

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee County Clerk Registration Renewals

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Car Loan Calculator Tennessee Dealer Consumer Calculator

Sales Tax On Cars And Vehicles In Tennessee

Iowa Sales Tax Rates By City County 2022

Indiana Property Tax Calculator Smartasset

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee County Clerk Registration Renewals

Tennessee County Clerk Registration Renewals

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue